Understanding Duty and Importing into Canada

IMPORTING INTO CANADA – WHAT COUNTRIES HAVE REDUCED DUTY OR DUTY FREE?

When importing items into Canada, the number 1 questions we are asked is “is it duty free?”. People feel that this will make up the largest portion of their cost and want to know the best way to minimize it. The best way to minimize duty is to know which countries to import from. Canada has many trade agreements with a wide variety of countries that offer reduced or 0% duty on items that would otherwise incur duty.

List of Agreements:

All current agreements are made available on the Government of Canada website for international trade. Those agreements are summarized below with the corresponding abbreviation.

|

Agreement name |

Abbreviation |

Countries/blocs involved |

Signed |

Entered into force |

|

FTA |

12 October 1987 |

1 January 1989 |

||

|

NAFTA |

17 December 1992 |

1 January 1994[a] |

||

|

CIFTA |

31 July 1996 |

1 January 1997 |

||

|

CCFTA |

5 December 1996 |

5 July 1997 |

||

|

CCRFTA |

23 April 2001 |

1 November 2002 |

||

|

CEFTA |

26 January 2008 |

1 July 2009 |

||

|

CPFTA |

29 May 2008 |

1 August 2009 |

||

|

21 November 2008 |

15 August 2011[b] |

|||

|

28 June 2009 |

1 October 2012 |

|||

|

14 May 2010 |

1 April 2013 |

|||

|

5 November 2013 |

1 October 2014 |

|||

|

CKFTA |

11 March 2014 |

1 January 2015 |

||

|

CUFTA |

11 July 2016 |

1 August 2017 |

||

|

CETA |

30 October 2016 |

21 September 2017 (provisional)[9] |

||

|

Comprehensive and Progressive Agreement for Trans-Pacific Partnership |

CPTPP, |

8 March 2018 |

30 December 2018 |

Source: https://en.wikipedia.org/wiki/Free_trade_agreements_of_Canada

Checking your item:

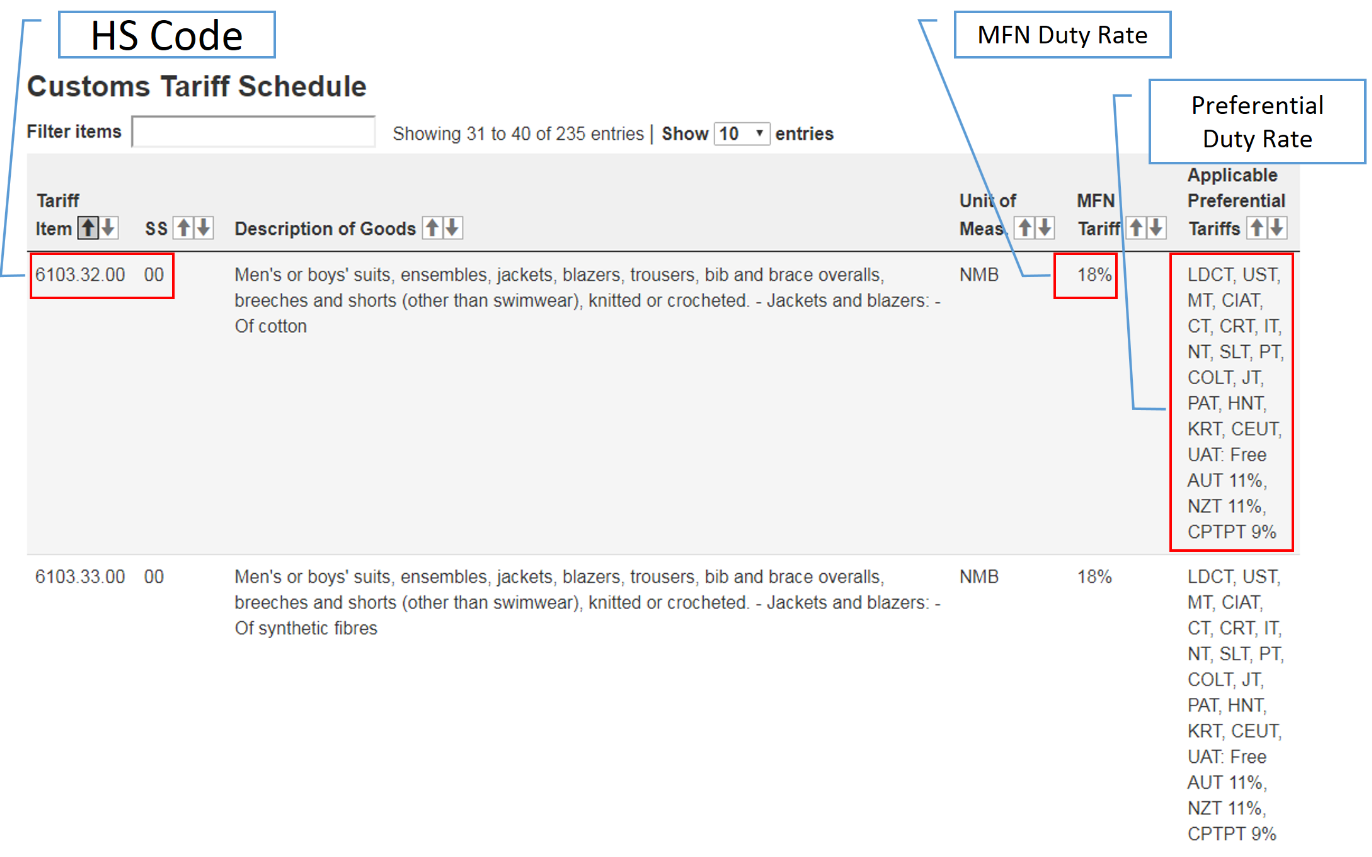

Every item imported must be classified with an HS Code. This code can be looked up in the Government of Canada Customs Tariff book available here.

Once you have identified your item, it is just a matter of looking at the correct column to determine the duty rate for it.

Reading the Canada Customs Tariff book:

After you have your HS code for your item, you can use the book to lookup the appropriate rate of duty.

Glossary:

HS Code: The Harmonized Tariff code for your item. The first 6-digits are internationally standardized, while the remaining 4 digits are country specific.

MFN Tariff or MFN Duty rate: The basic duty rate for your item if the origin country does not have a preferential rate.

Preferential Tariffs or Preferential Duty rate: The special rate if the origin country has a Trade Agreement or qualifies for the Preferential rate.

Our expertise can help you not only to navigate the tariff and intricacies of the Tariff Book, but also do find the most appropriate code for your goods. Leveraging our experience, finding the correct code and the best possible duty rate can have a significant impact on your decision to import the good, and which country you are sourcing your items from. The ever evolving landscape of international trade can be difficult without sound advice, and that is where we can help.

Contact us today and we can help you navigate the process and set you up for success.